Driving Value creation from India Part 1: Indian IT Evolution and Current State

December 27, 2023

This series will present an overview of the Indian technology ecosystem, key trends in globalization and offshoring. These articles will help understand how as a business partner NTT DATA INTELLILINK (NDIL) can contribute to your organization's strategic initiative towards digital transformations. This series is mainly based on NDIL and Zinnov Consulting joint research and analysis and will be divided into 4 parts:

- 1.The 1st part provides an introduction, bird's eye view of the IT business ecosystem in India.

- 2.The 2nd part will talk about the growth and evolution of the technology ecosystem in India, an overview of the talent pool, key drivers for growth and anticipated trends and headwinds for the industry.

- 3.The 3rd part will talk about how beneficial it is to have start towards digital transformation.

- 4.The 4th part will state how NDIL can contribute to setup dedicated team for your business growth.

Evolution of Indian IT Industry:

India is a global powerhouse in Information Technology and the Software industry. Evolution of the IT in India was organic, and now, has the highest share of the STEM (Science, Technology, Engineering and Mathematics) workforce, globally. The following diagram explains the Indian IT industry evolution phases since 1990s till today.

Figure 1: Indian IT Industry evolution[d]

Current State of India IT:

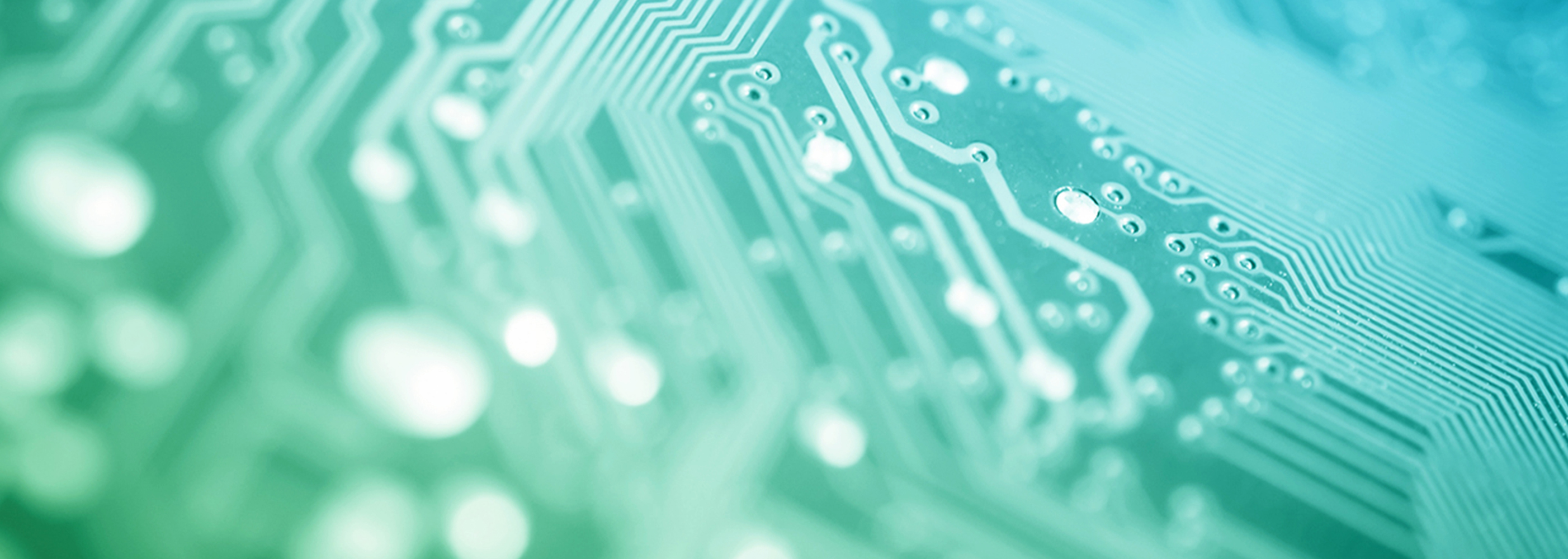

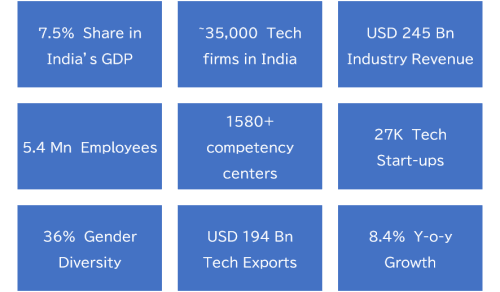

Continuous evolution, political support and people technical capabilities have enabled India as the preferred investment destination among global investors across geographies. In turn it has created huge job opportunities, and India revenue steady growth, IT accounts for almost 7.5%-8.0% of India's GDP. The capabilities and flexibility of Indians to deliver both onshore and offshore maintains the cost effectiveness as well as achieving optimal quality for global clients. The reliable and speedy services fulfil the competitive edge for clients in such a dynamic scenario of digital and emerging technologies. With boost to startup culture, India offers the state-of-the-art emerging technologies viz Generative AI, Quantum computing, Cybersecurity etc creating lot more opportunities.

Figure 2: Revenue Indian IT Industry[c]

The Indian IT/ITes industry has a leading position globally and progressively contributing to the growth of exports. India's IT industry is expected to grow by 7.9% with revenue of USD 245 billion during FY23[b,c]. In India the Ministry of Electronics and Information Technology is supporting following for India’s leadership position in IT and IT-enabled Services:

- a.Coordinating strategic activities

- b.Promoting skill development programmes

- c.Enhancing infrastructure capabilities

- d.Supporting R&D

| FY2022 | y-o-y growth | Brief | |

|---|---|---|---|

| IT services | $104 billion | 8.3% | Continues to lead in terms of market share |

| ER&D | $41 billion | 11.1% | Cloudification, Digital software-led products |

| Software products | $7.3 billion | 7.8% | Collaborative applications, application platforms, security software, system & service management software and content workflow & management applications |

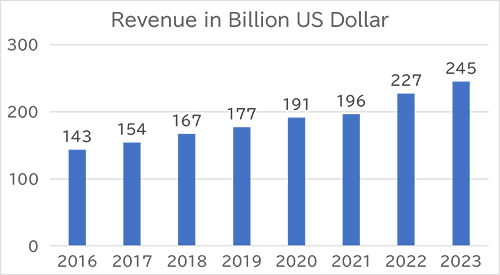

Figure 3: ICT Service Exports[a]

Major India export destinations / markets includes USA, UK and EU accounting for 62%, 17% and 11% of the total IT-ITeS exports respectively, however, there are new challenges surfacing in these traditional geographies. Demands from Asia Pacific (APAC), Latin America and Middle East Asia is growing, and newer opportunities are emerging for expansion in continental Europe, Japan, China and Africa.

- ・The key drivers for approx. 8.3% IT services growth accounting for 51% share of overall industry are:

- ・IT modernization

- ・Greater focus on cybersecurity

- ・Platformization

- ・Migration to the cloud and digitization

- ・Global organizations are focused on expanding the presence of Shared Services teams in India, in addition to the expansion of existing IT and Technology teams.

- ・ER&D will achieve double digit growth (approx. 11.1%). Mainly based on the increased focus of companies on the:

- ・Digitalization of products and processes

- ・The maturity of talent pool in India

- ・De-risking from other global locations to ensure business continuity

Snapshot of current IT industry in India:

Figure 4: Current Technology Industry in India[d]

The talent pool in India is amongst the largest and the most cost-effective globally. The largest share of this pool comes from external Service Providers. With a total STEM talent pool of 1.56 Mn, India has approx. 10X the number of STEM graduates as Japan, year-on-year. The IT/ITeS is estimated to employ 5.4 million professionals, an addition of 290,000 people over FY 2021-2022. Women employees account for 36% share in total industry employee base.

Offshoring represents the annualized savings of approx. 30% where System Integrators can support Organizations achieve this. A recent study by Zinnov revealed that 77% of companies across various industries using SI partner services. The benefits are clear—greater control over operations, improved quality, enhanced customer experience and long-term cost savings. Several multinational companies have already leveraged the Indian ecosystem successfully, where the SIs become partners to the organizations.

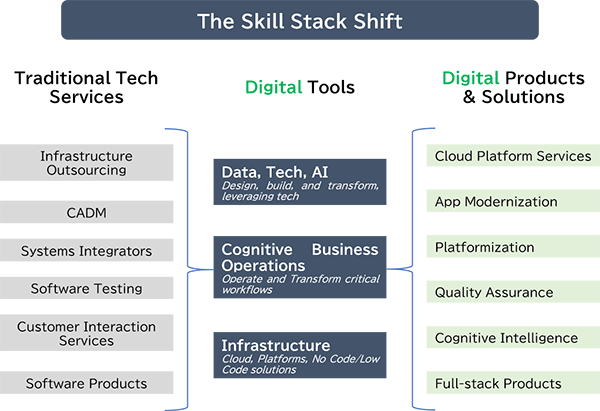

Skill Stack Shift in India:

Figure 5: Skill stack shift[d]

The Indian IT industry is growing at robust pace driven by greater acceptability of outsourcing concept. The key drivers for this growth include verticals like Banking and Financial Services companies, Pharma and Legal Services, Automotive. Indian IT employees and STEM able to catchup with the evolution of technology. The faster adoption to digital technologies boosts the overall opportunities and opportunities for geographical expansion. The snap of skill stack shift can be visualized in figure. The government initiatives in digital transformations pushed the limits and ample of opportunities for idea generation. The country is rapidly establishing itself as a major player in the digital economy. To keep up with and fuel India's digital transformation, continuous research and development of new IT products and services, as well as the production of innovative solutions, continues with R&D labs, academic institutions and startup incubators. The country currently has over 27K tech-driven startups registered, with another 1,300 added each year. The industry has grown shifted significantly from legacy to new-age digitized processes. India is expected to be $687 billion IT powerhouse by 2027.

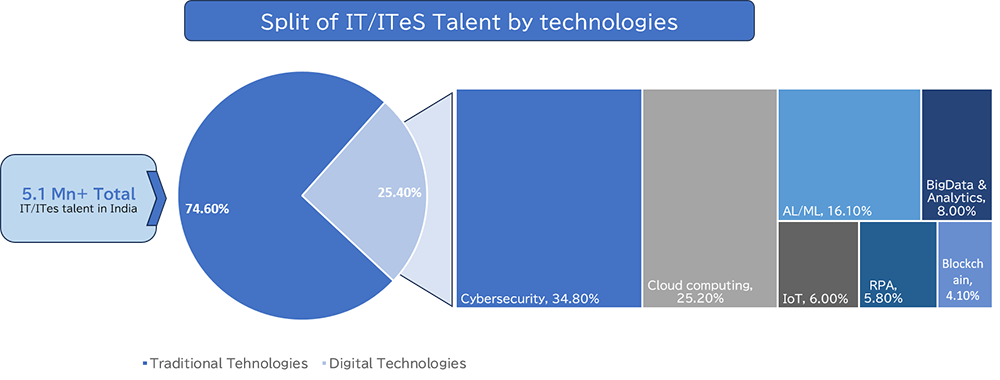

Figure 6: Evolution of Digital Talent[d]

Shifting from traditional technologies towards digital, more than 25% IT talent working in Digital technologies viz Cybersecurity, Cloud Computing, AI/ML, IoT, Big Data and Analytics, Blockchain etc. India is the third-largest producer of AI talent in the world, contributing approx. 16% of it. approx. 67% of talent in Cloud Computing is trained in Amazon Web Services (AWS), approx. 55% in Microsoft Azure and approx. 17% in Google Cloud Platform (GCP).

Conclusion:

Overall, Indian IT industry is growing at robust pace demonstrating flexibility to support across time zones, adaptability: fast capability building in digital and emerging technologies, talent pool supporting innovation and providing services efficiently and competitively. In the second part of this series lets dive through an India overview of the talent pool, key drivers for growth and anticipated trends and headwinds for the industry and how India is emerging as world's top IT services hub.

References:

- [a]https://wits.worldbank.org/CountryProfile/en/country/by-country/startyear/LTST/endyear/LTST/indicator/BX-GSR-CCIS-CD#

- [b]https://www.meity.gov.in/content/software-and-services-sector

- [c]https://www.statista.com/

- [d]NTT DATA INTELLILINK and Zinnov research paper.

- Note:Product names, company names and organization names in this text are generally trademarks or registered trademarks of each company.